Specialist in foreign companies in France

Year after year, MIA Assurances has acquired in-depth expertise with its international clientele. We work with a number of international companies that have an entity in France.

Year after year, MIA Assurances has acquired in-depth expertise with its international clientele. We work with a number of international companies that have an entity in France.

If you own or are starting up a business in France and want to take on employees, you will need to familiarise yourself with French social protection regulations. As an employer, you will have to comply with a number of social obligations to ensure that your employees are recognised by the various French bodies.

We specialise in assisting foreign firms in France, and we put our expertise at your service to help you manage your social obligations.

Our bilingual international team is at your disposal at every stage of setting up your health and life insurance. We have negotiated specific agreements tailored to the needs of foreign companies, whether or not they have an establishment in France.

We can guide you through the process, taking into account your specific needs. Contact us today to receive a free, no-obligation, personalized quotation.

With nearly 30 years’ experience in social protection in France, MIA Assurances has forged numerous partnerships and negotiated special terms to offer you solutions adapted to your needs. Find out here what foreign companies in France need to know:

1. Retroactive effective date

The possibility of choosing a retroactive effective date is a crucial advantage. It allows you to cover medical expenses already incurred by your employees before the policy is taken out, thus avoiding any unforeseen financial inconvenience. A retroactive effective date means that medical expenses incurred by your employees since the start of their employment contract will be covered, giving your employees peace of mind.

2. Payment of contributions from a foreign account

The ability to pay contributions from a foreign account simplifies financial management for international companies.

3. Take out a policy before obtaining a SIRET number

Being able to take out your contract before obtaining your SIRET number is a step that allows you to prepare your social protection effectively before starting your operations in France. This means that you can put in place cover for your employees even before your company is fully operational.

4. Outsourcing administrative tasks

Delegating the administrative aspects to your payroll firm is a practical solution that makes it easier to manage your employees in France, saving you time and ensuring you are compliant.

When a foreign company decides to set up in a new market, it faces a series of challenges. Laws, regulations and risks vary from one country to another, making it essential to have appropriate insurance to cover these specific risks.

In France, offering your employees health and provident cover is a legal requirement. But beyond this obligation, it is a strategic investment for your company. That’s why it’s essential to choose an insurance policy that meets your specific needs.

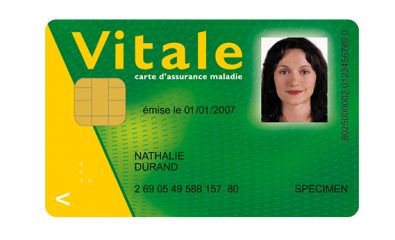

A mutual insurance contract will reimburse healthcare costs in addition to the French Social Security system. Offering your employees a comfortable level of cover is an undeniable asset for building loyalty.

All employees in France should be able to benefit from company social security cover. However, it’s not just a question of complying with the regulations. Offering your employees a comfortable level of cover is an undeniable asset for attracting and retaining talent. By choosing your insurance policy wisely, you are investing in the safety and well-being of your team, which translates into greater motivation and productivity.

If you are interested in our expertise and would like a free, no-obligation, personalised study, please contact us today. We’d be delighted to help you set up your insurance policy.

Measure your company’s social climate and the quality of life at work with the Social Barometer

It is crucial to establish a healthy social climate and involve all employees in the…

Sector 2 Practitioners: what does it mean ?

When scheduling an appointment with a doctor, you may wonder about the difference between non-contracted…

Nurturing your employer brand with quality employee benefits

Are you opening your business and discovering the impact of social charges on your profitability?…

What is a state-approved “responsible” supplementary health insurance plan?

When it comes to choosing a company health insurance plan for your employees in France,…