Group cover for VSEs and SMEs

Are you offering your employees the best cover on the market? Consider negotiating your rates and benefits to give your team the best possible experience!

Are you offering your employees the best cover on the market? Consider negotiating your rates and benefits to give your team the best possible experience!

Whether you have 2, 10, 50 or 100 employees in your company, the issue of social protection is at the heart of your HR strategy to ensure the best quality of life for your team.

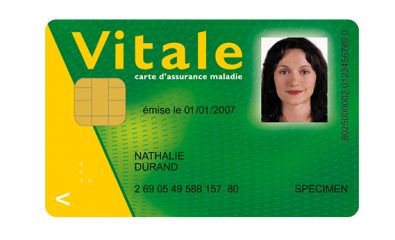

Healthcare, life insurance and supplementary pensions are all necessary or essential if your employees want to feel protected. It’s vital to reassure them by giving them access to appropriate healthcare and helping them anticipate the end of their professional career with a pension that meets their expectations.

As an HR manager or director, you may already have taken out group health and life insurance policies for your employees. In the context of inflation in France, the health sector has not been spared. At a time of rising healthcare costs, good insurance cover is more important than ever. At the same time, you need to keep your budgets in check, so you may want to challenge your existing contracts.

Are your contracts still the most competitive on the market? Are you satisfied with the digital tools at your disposal? Are the levels of reimbursement sufficient?

We are a group insurance broker (complementary health insurance, life insurance, supplementary pensions, etc.) and our job is to ensure that you get the best deal on the market, taking into account your budget, the number of employees, their family composition and your company’s sector of activity.

Our studies are free and non-binding. We are remunerated by the French insurers with whom we work. Don’t hesitate to contact us, because MIA Assurances will save you a considerable amount of time, from benchmarking to providing information to your teams.

MIA Assurances will advise you, FREE OF CHARGE AND WITHOUT ANY COMMITMENT:

Good social protection is a significant salary advantage for your employees. Not only is it a way of building loyalty, it’s also a way of offering an attractive salary package. Employee savings solutions make it possible to offer attractive remuneration that is less taxed.

Measure your company’s social climate and the quality of life at work with the Social Barometer

It is crucial to establish a healthy social climate and involve all employees in the…

Sector 2 Practitioners: what does it mean ?

When scheduling an appointment with a doctor, you may wonder about the difference between non-contracted…

Nurturing your employer brand with quality employee benefits

Are you opening your business and discovering the impact of social charges on your profitability?…

What is a state-approved “responsible” supplementary health insurance plan?

When it comes to choosing a company health insurance plan for your employees in France,…