What is a group life insurance?

A group life insurance is a cover put in place by a company for its employees, in order to protect them against the hazards of life, such as illness, disability, death or incapacity for work. This plan is generally taken out with an insurance company, and offers group coverage to all employees, or to a specific category of them.

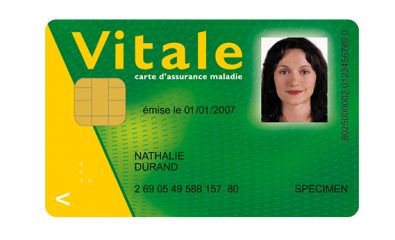

Group insurance differs from individual insurance. It is compulsory for certain groups of employees, and is often financed in whole or in part by the employer. It supplements the benefits provided by Social Security and basic life schemes, giving employees enhanced protection.

Ask MIA Assurances for advice

What is it for?

The main aim of group life insurance is to provide financial security for employees in case of events affecting their ability to work and, consequently, their income. It plays a crucial role in the social protection of employees and contributes to their well-being within the company.

What benefits are covered?

A group life insurance plan will supplement the basic health insurance scheme with the following benefits:

Protection in the event of sick leave: in the event of temporary incapacity for work due to illness or accident, the group life insurance plan enables the employee to receive daily allowances in addition to those paid by Social Security, in order to maintain their level of income.

Disability and Incapacity: if the sick leave is prolonged and leads to a disability, the group life insurance offers a disability annuity to help the employee compensate for the loss of income.

Death: in the event of the employee’s death, his or her next of kin benefit from a lump sum or annuity, helping to provide financial support at this difficult time.

Prevention and support: some group life insurance plans also include assistance, prevention and support services, designed to help employees through the difficult times in their lives.

Is group life insurance compulsory?

While complementary health insurance plans are compulsory for all companies, life insurance must be systematically offered:

– For all managerial staff,

– Or when imposed by the national collective agreement.

Therefore, group life insurance is not compulsory in all cases.

Make a difference for your employees!

When it comes to recruiting new employees in France, don’t overlook the positive impact that such benefit can have on your employees: it provides real security for them and their families in the event of more or less serious health problems. The portion covered by the basic French health insurance scheme is far from adequate. If you take out a group provident insurance policy, you will have to pay at least 50% of the premiums.

So, how do you choose the right plan among all the offers on the market? First of all, you need to be aware of your company’s collective bargaining agreement, which may set a minimum level of cover. Then, depending on the size of your company, you may opt for either a standard or standalone plan. Finally, you can compare waiting periods, deductible days, exclusions and contribution levels.

Count on MIA Assurances to help you find the best offer on the market, meeting your criteria!

Get a quote