Offer your employees the best possible health insurance cover

Whether it is for a 1st implementation, or to challenge your existing contracts.

Whether it is for a 1st implementation, or to challenge your existing contracts.

In today’s business environment, taking care of employees has become a priority for companies. Setting up a complementary group health insurance scheme is the best way to ensure the health and well-being of your teams. But what exactly is a group health insurance plan, and how does it benefit employees and the company? How to choose and subscribe to a group health insurance scheme? These are just some of the questions we’ll be answering in this article.

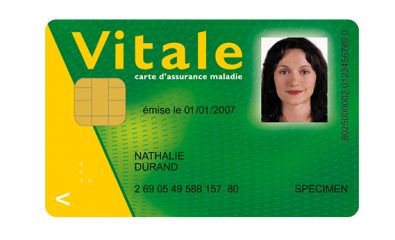

Group supplementary health insurance, also known as “mutuelle d’entreprise”, is a benefit plan taken out by the employer for its employees, to supplement reimbursements for healthcare not covered by Social Security. It covers all or part of outpatient, inpatient and pharmaceutical expenses, and can even extend to preventive and wellness services. Since the ANI law of 2016 in France, it has been compulsory for all companies to offer their employees a complementary health plan.

The aim of group supplementary health insurance is to strengthen the social protection of employees. It contributes to improving their access to healthcare, by reducing the out-of-pocket healthcare costs they incur. This translates into better coverage of healthcare expenses, whether for medical consultations, drug purchases, hospitalization costs, or dental and optical care.

By offering this protection, the company plays an active role in the health and well-being of its employees, fostering their job satisfaction and commitment. It is also an important factor in attracting and retaining talent.

Extra Fees Cover

Dental and Optical Care Cover

Alternative Medicine Cover

Prevention Cover

TPA Service Quality

Digital Tools

There are a number of criteria to look at when choosing the best company health insurance plan. These include:

• Your company’s business sector: your National Collective Bargaining Agreement certainly provides for a minimum level of coverage. MIA Assurances always analyzes your company’s Collective Bargaining Agreement,

• The composition of the family and age of your employees to be covered,

• The area where your employees live as medical expenses and excess fees vary from one region to another.

Don’t hesitate to request a review of your employee benefits from MIA Assurances, including a comparison of the products available, to help you choose the best plan for your company.

Get a quote from MIA Assurances

Measure your company’s social climate and the quality of life at work with the Social Barometer

It is crucial to establish a healthy social climate and involve all employees in the…

Sector 2 Practitioners: what does it mean ?

When scheduling an appointment with a doctor, you may wonder about the difference between non-contracted…

Nurturing your employer brand with quality employee benefits

Are you opening your business and discovering the impact of social charges on your profitability?…

What is a state-approved “responsible” supplementary health insurance plan?

When it comes to choosing a company health insurance plan for your employees in France,…