100% Healthcare reform: key updates for 2026

Since its gradual rollout, the 100% Health scheme has significantly transformed access to care in…

Employee Benefits: A bilingual glossary

A complex system for foreign companies The French social system is recognized for its richness,…

Employee Savings Plans in SMEs: An HR and Tax Lever to Rediscover

A Long-Underestimated Scheme Often seen as the preserve of large corporations, employee savings plans are…

How to present your benefits policies during employee onboarding

HR onboarding is much more than a simple administrative formality : it’s a strategic step in…

PERO: Helping employees save for retirement

In France, companies can implement a PERO (Plan d’Épargne Retraite Obligatoire), a collective pension savings…

Why retirement planning matters for employers in France

The French pension system is under increasing pressure.As the population ages and public coverage declines,…

MIA Assurances Earns B Corp™ Certification: A Demanding Label for a Committed Vision of Insurance Brokerage

A Broker That Puts People First Since its inception, MIA Assurances has had a clear…

Employee Savings Plan, HR, Strategic Lever

A Powerful Yet Often Underestimated Benefit Often viewed as a technical topic reserved for large…

Digitalization for Better Support: MIA Assurances Reinvents Its Sales Journey

In 2025, MIA Assurances takes a bold step forward in innovation by fully digitalizing its…

Value Sharing Law: An Opportunity for SMEs

Since January 1, 2025, the Value Sharing Law requires companies with 11 to 49 employees…

Measure your company’s social climate and the quality of life at work with the Social Barometer

It is crucial to establish a healthy social climate and involve all employees in the…

Sector 2 Practitioners: what does it mean in 2025 ?

When choosing a doctor in France, you may come across the term Sector 2 practitioner.…

Nurturing your employer brand with quality employee benefits

Are you opening your business and discovering the impact of social charges on your profitability?…

What is a state-approved “responsible” supplementary health insurance plan?

When it comes to choosing a company health insurance plan for your employees in France,…

Why choose a health insurance top-up plan?

When it comes to choosing a company healthcare plan for your employees, you’ll hear talk…

SEPA direct debit: how it works and how to set it up

Since 2014, the SEPA Direct Debit has been the only automatic payment system in the…

Is company supplementary health insurance compulsory?

Are you hiring in France and looking for information on setting up a group supplementary…

Simplify Company Formalities with Foreign Firms Title

You are an international company with no establishments in France and wish to hire an…

DPAE: Mandatory declaration before hiring

The Déclaration Préalable à l’Embauche (DPAE), formerly known as the Single Hiring Declaration (DUE), is…

Declaring your company in France using the M0 form

Are you an international company setting up a business in France? Establishments in France are…

Déclarer une société étrangère avec le guichet unique

Vous êtes une société étrangère et ouvrez un établissement en France ? Vous avez désormais…

Declaring a foreign company using the one-stop service

Are you an international company starting a business in France? You can now complete your…

How to convert gross salary to net salary

Are you hiring your first employees in France and looking to set their level of…

Setting up in France: why should you apply for a tax ruling?

If you are an international company looking to hire in France, you will have to…

Registering with Urssaf Alsace: is it compulsory?

Are you setting up your business and starting the process of registering your first employees…

What formalities do you need to complete when hiring in France?

Are you an international company wishing to start up its commercial activity in France? Then…

How to set up Nominal Social Declaration (DSN)?

Nominal Social Declaration, or DSN, generalized since January 1st, 2019, is a mandatory formality for…

Mandatory benefits for your employees in France

When you’re hiring your first employees in France, you may have some questions about the…

Mandatory health insurance certificate: 2025 guide

The mandatory health insurance certificate proves that an employee is covered by the company’s group…

What is portability?

Is one of your employees leaving and wants to continue to benefit from the company…

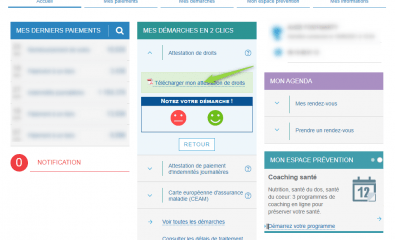

Health data transmission: definition, benefits, and how to activate it easily

Have you heard about the data transmission service but aren’t sure what it is or…

Nominal Social Declaration (DSN): best practices

You are a payroll provider, or an HR department within the payroll department, and you…

Setting up a company Retirement Savings Plan (RSP)

Is your company thinking about setting up a Retirement Savings Plan (RSP)? 172,000 French companies…

HR: What should you do in case of an employee sick leave in 2025?

If you’re not familiar with the French formalities required when an employee is on sick…

Mandatory DUE in 2025: Ensure URSSAF Compliance

As of January 1, 2025, all private-sector companies in France that have implemented a group…

About your National Collective Bargaining Agreement

The role of National Collective Bargaining Agreements in French labor law is fundamental. Collective Bargaining…

Where can I find my health insurance certificate of entitlement?

Are you an employee in France and enrolled in the general Social Security scheme? In…